In July 2025, DPES overseas promotion team will bring high-quality exhibitor information to Brazil, Thailand, and Pakistan.We will meet local buyers and industry partners face to face for one-on-one business matchmaking.Our goal is to help exhibitors explore international markets and invite more quality buyers!

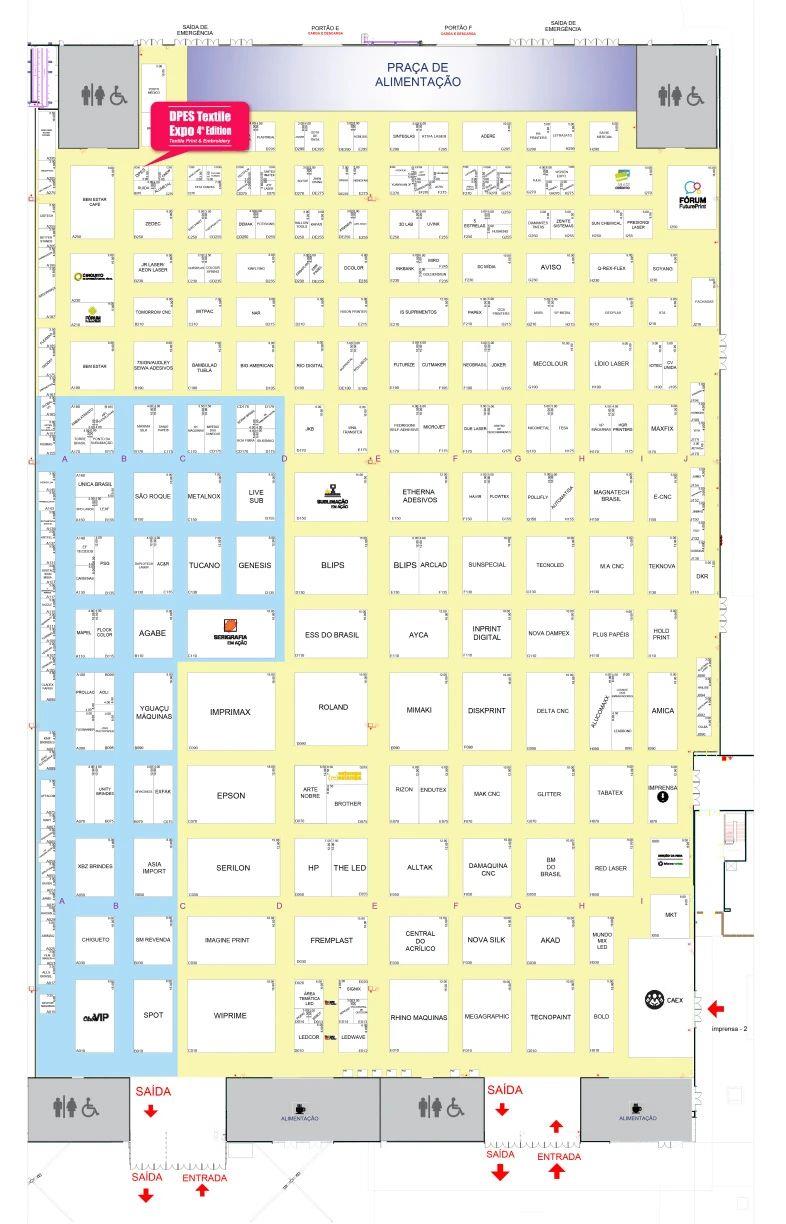

一 Brazil Textile Market

Brazil has a population of 210 million (as of 2023), with around 50% belonging to the middle class and having strong purchasing power. Domestic demand is the main driving force of the textile industry, accounting for over 70% of the industry’s total output. Textiles and apparel are an important part of everyday consumer spending in Brazil. In the clothing sector in particular, local brands compete fiercely with international fast fashion brands such as Zara and H&M.

1. Upstream: Major Global Cotton Producer

Brazil is the 3rd largest cotton producer and 2nd largest exporter in the world. In 2022/23, cotton exports reached 2.5 million tons.

2. Midstream: Strong Processing Capacity

Brazil has solid spinning, weaving, and dyeing capabilities. However, high-end fabrics (functional, eco-friendly) are mostly imported.

Some companies are investing in automation to improve efficiency.

3. Downstream: Garment Production

Brazil is one of the top 10 garment producers globally (2022 output valued at USD 60 billion).

However, high labor costs limit export competitiveness. Most domestic production focuses on mid-to-low-end products, while high-end garments are mostly imported.

二 Thailand Textile Market

Thailand is an important country in Southeast Asia's textile and garment manufacturing industry, with over 2,000 textile and apparel companies, mainly located in Bangkok and the eastern regions. The industry contributes about 10% to the country’s manufacturing GDP.

Thailand’s textile market has a strong advantage in garment manufacturing, supported by a well-developed supply chain, benefits from regional trade agreements, and government policy support. It holds a significant position in the global mid- to high-end garment and automotive interior textile sectors.

Although the industry faces rising labor costs and increasing competition, Thailand maintains its competitiveness as a “quality-oriented exporter” in Southeast Asia due to its advanced manufacturing capabilities, shift toward sustainability, and strong regional market potential.

In the future, Thailand's textile industry is expected to focus on developing high value-added products (such as functional garments and smart textiles), strengthening sustainability certifications, and deepening cooperation with the regional automotive industry.

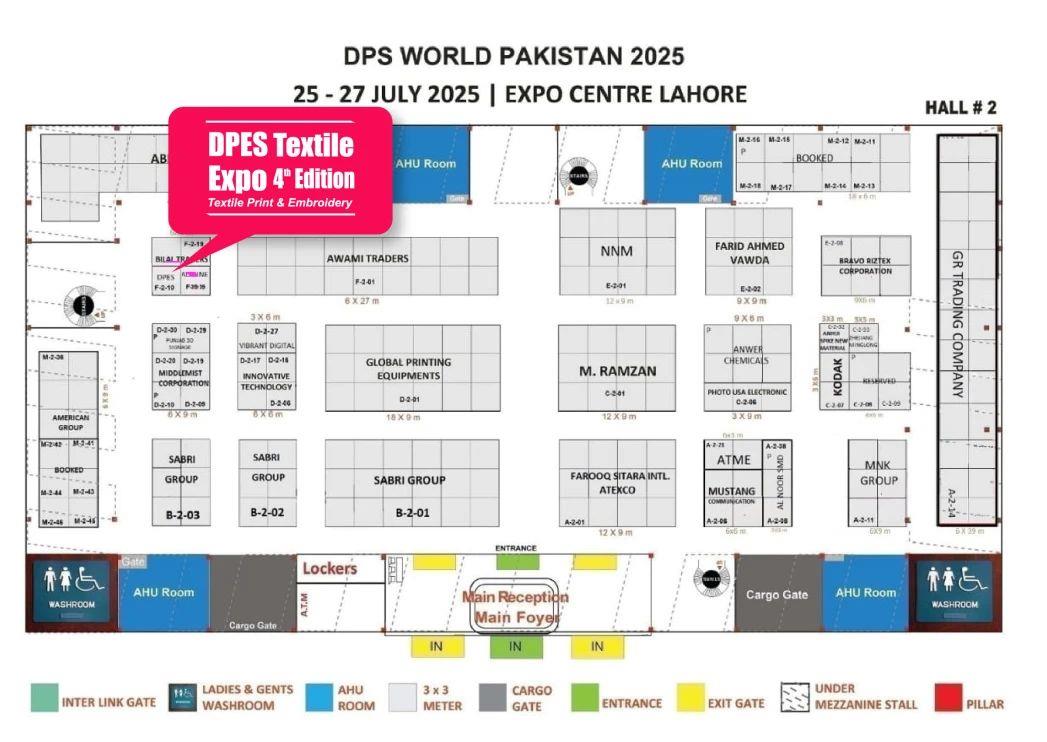

三 Pakistan Textile Market

Pakistan is an important country along the Belt and Road Initiative and a key economic and trade partner of China in South Asia. The textile industry is a pillar of Pakistan’s economy and employment, with over 4,000 textile enterprises across the country. The industry has formed a complete value chain, from cotton cultivation, spinning, weaving, and dyeing to garment manufacturing.

Relying on world-class cotton resources and low labor costs, Pakistan holds a significant position in the global supply chain, especially in the "cotton–yarn–greige fabric" segment. It is an important supplier to markets such as the European Union and China.

Despite facing challenges such as energy shortages, weak links in the value chain, and growing international competition, Pakistan’s textile industry is expected to upgrade from a “cotton-exporting country” to a “high value-added textile manufacturing country.” This shift is driven by the development of the China-Pakistan Economic Corridor, benefits from the EU GSP+ scheme, and increasing regional demand. The industry aims to achieve this through technological upgrades (such as the adoption of automated equipment), value chain extension (such as improvements in dyeing processes), and sustainable transformation (such as the promotion of organic cotton).

Industry leaders are calling for a “China-style” digital transformation of the industrial sector.

Why Choose DPES CHINA 2026?

Data proves our strength.

DPES is attracting more and more international visitors.

We’ve established a stable presence in key markets and made fast breakthroughs in emerging markets.

Our global brand influence is expanding steadily.

What’s Next?

DPES CHINA 2026 is actively growing its global network.

We’re on the move—inviting, engaging, and expanding.

Next year, we’ll connect with top buyers from South America, Southeast Asia, and South Asia,dig deeper into buyer resources,and help our exhibitors grow their global business!